|

|

|

CHEMICAL OUTLOOK: ENERGY, ECONOMIC

AND SOCIETAL IMPACTS ON CHEMICAL PROSPECTS

Monthly report identifies and analyzes the most important external and strategic factors affecting the U.S. and global chemical industry, ranging from economic developments in Asia, to changes in energy pricing, to new government policies, to mergers and acquisitions. Highly readable and concise. Data tables with economic data affecting chemicals. Four (5) to Ten (8) pages per issue, delivered by E-mail as pdf files and with IP authorized access on Probe's website -- normally with company-wide distribution. The cost depends on the size of the company and its degree of involvement with the subjects covered by the reports.

Contact:

Frederick M. Peterson

Probe Economics LLC

1755 Pelican Way

Vero Beach, FL 32963 U.S.A.

Fax: (603) 369-6413

Phone: (603) 667-3636

E-mail: fred@probeeconomics.com

|

Tables of Contents from Past Issues

November, 2018

| U.S. Economy. | (Page 1) |

| European Economy. | (Page 2) |

| Chinese Economy. | (Page 2) |

| Indian Economy. | (Page 2) |

| Brazilian Economy. | (Page 2) |

| Effect of Fracking and LNG on Oil Prices, with Forecast. | (Page 3) |

| Energy Impact of Data Centers. | (Page 5) |

| U.S. Becomes More Self-Sufficient in Nitrogen. | (Page 5) |

| Table: Economic, Chemical and Energy Indicators. | (Page 6) |

April, 2013

| U.S. is Still OK. | (Page 1) |

| Bifurcated Euro? | (Page 2) |

| Underground Economy. | (Page 2) |

| China Maturity and Debt. | (Page 2) |

| How Much National Debt is Too Much? | (Page 3) |

| Natural Gas Elsewhere. | (Page 3) |

| Chemical Slowdown? | (Page 4) |

| End of Saudi Dominance? | (Page 5) |

| Is Chinese Coal-to-Olefins Economic? | (Page 5) |

| Table 1: Economic and Chemical Industry Indicators: Soft. | (Page 6) |

| Table 2: Energy and Chemical Prices: Lower Crude Prices. | (Page 7) |

March 2009

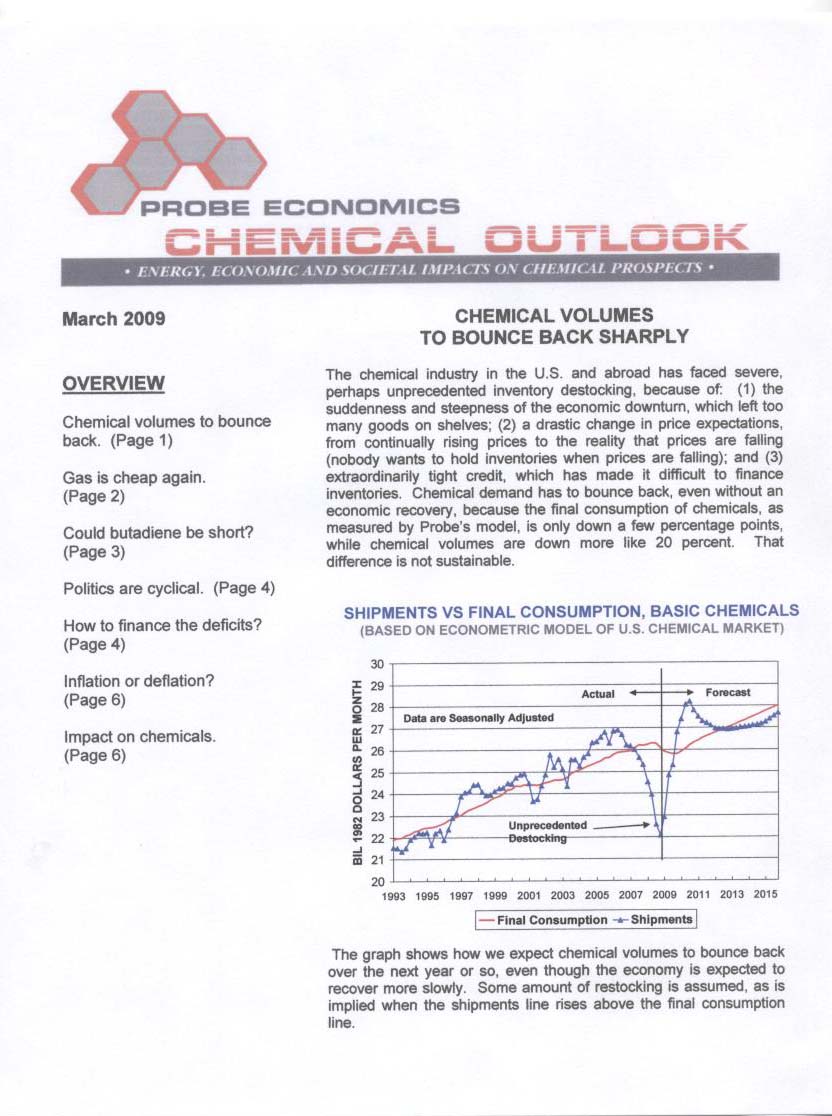

| Chemical volumes to bounce back. | (Page 1) |

| Gas is cheap again. | (Page 2) |

| Could butadiene be short? | (Page 3) |

| Politics are cyclical. | (Page 4) |

| How to finance the deficits? | (Page 4) |

| Inflation or deflation? | (Page 6) |

| Impact on chemicals. | (Page 6) |

| Table 1: Economic and Chemical Industry Indicators. | (Page 7) |

| Table 2: Energy and Chemical Prices. | (Page 8) |

Downloads:

Back To Publications

For more information, E-Mail us at fred@probeeconomics.com

Copyright © 2023 Probe Economics LLC All rights reserved.

|

|